Is Business Health Insurance Mandatory Or Not? Here's What You Need To Know

Let’s cut to the chase, folks. If you're running a business in today's world, one question keeps popping up: is business health insurance mandatory or not? It’s like that awkward conversation at a dinner party, but way more important. Whether you're a small business owner or managing a corporate empire, this topic is crucial. So, let’s break it down and figure out what’s really going on here. You don’t wanna miss this because it could save you a ton of trouble later.

Business health insurance has been a hot topic for years now. With healthcare costs skyrocketing faster than a rocket ship, companies are left scratching their heads trying to figure out if they're legally obligated to provide coverage for their employees. And trust me, it’s not as simple as flipping a coin. There are rules, regulations, and loopholes that make it feel like you're navigating a maze.

But here’s the thing: understanding whether business health insurance is mandatory or not isn’t just about staying on the right side of the law. It’s also about taking care of your people. Employees are the backbone of any company, and their well-being directly impacts productivity. So, let’s dive into this topic and uncover the truth once and for all.

Understanding the Basics of Business Health Insurance

What Exactly is Business Health Insurance?

Alright, let’s start with the basics. Business health insurance is basically a safety net for employees. It’s like having an umbrella when it rains—except instead of rain, it’s medical bills. This type of insurance covers healthcare expenses for employees, including doctor visits, hospital stays, prescriptions, and other medical services. But here’s the kicker: not every business is required to offer it.

In the United States, for example, the Affordable Care Act (ACA) mandates that companies with 50 or more full-time employees must provide affordable health coverage. But if you’re running a smaller outfit, you might not be obligated. However, offering health insurance can still be a smart move because it attracts top talent and boosts employee morale.

Is Business Health Insurance Mandatory?

Depends on Where You’re Located

Now, here’s where things get interesting. The rules around business health insurance vary depending on where your business is located. In countries like France, for instance, health insurance is mandatory for all employers. It’s part of the social security system, and businesses are required to contribute to employee health coverage. But in other places, like the US, the rules are a bit more flexible.

So, if you’re wondering whether business health insurance is mandatory or not, the answer is: it depends. You’ve got to do your homework and understand the legal requirements in your specific location. And trust me, you don’t want to get hit with fines or penalties because you didn’t do your due diligence.

Legal Requirements for Business Health Insurance

Let’s talk about the legal side of things. In the US, the ACA requires companies with 50 or more full-time employees to provide health insurance. But what about smaller businesses? Well, they’re not technically required to offer coverage, but they can still benefit from doing so. Offering health insurance can help attract and retain employees, which is a big deal in today’s competitive job market.

Now, let’s break it down further. If you’re a small business with fewer than 50 employees, you’re not legally obligated to provide health insurance. But here’s the thing: you might still want to consider it. Why? Because happy employees are productive employees, and health insurance is a great way to keep your team feeling valued and supported.

Key Points to Remember

- Companies with 50+ employees must provide health insurance under the ACA.

- Smaller businesses aren’t legally required, but offering coverage can be beneficial.

- Check local regulations to ensure compliance.

Benefits of Offering Business Health Insurance

Why Should You Care?

Even if business health insurance isn’t mandatory for your company, there are plenty of reasons to offer it. First and foremost, it shows your employees that you care about their well-being. And let’s face it, happy employees are more likely to stick around and work hard for you. Plus, offering health insurance can give you a competitive edge when it comes to hiring top talent.

Another benefit? Tax deductions. If you’re providing health insurance as part of your employee benefits package, you might be eligible for tax breaks. And who doesn’t love saving money on taxes? It’s like finding an extra $20 in your pocket at the end of the day.

Costs and Considerations

Now, let’s talk about the elephant in the room: cost. Offering business health insurance isn’t cheap, especially for small businesses. But there are ways to make it more affordable. For example, you can offer high-deductible plans that come with lower premiums. Or, you can partner with a broker to find the best rates for your company.

It’s also important to consider the long-term benefits. While the upfront costs might seem daunting, the return on investment can be significant. Happy, healthy employees are more productive, which can lead to increased profits for your business. So, while it might feel like a big expense now, it could pay off in the long run.

How to Keep Costs Down

- Offer high-deductible plans with lower premiums.

- Partner with a broker to find the best rates.

- Encourage preventive care to reduce long-term costs.

Common Misconceptions About Business Health Insurance

There are a lot of myths and misconceptions floating around about business health insurance. Some people think it’s too expensive, while others believe it’s unnecessary. But the truth is, offering health insurance can be a win-win for both employers and employees. It’s not just about compliance; it’s about creating a positive work environment where everyone feels valued.

Another common misconception is that small businesses can’t afford to offer health insurance. But with the right strategies and resources, even the smallest companies can provide coverage for their employees. It’s all about finding the right balance between cost and benefit.

Debunking the Myths

- Health insurance isn’t just for big companies.

- Small businesses can afford to offer coverage with the right strategies.

- Providing health insurance is more than just compliance—it’s about employee well-being.

Real-Life Examples and Success Stories

Let’s look at some real-life examples of businesses that have successfully implemented health insurance programs. Take Company X, for instance. They’re a small startup with 20 employees, and they were able to offer affordable health insurance by partnering with a local broker. The result? Increased employee satisfaction and retention rates.

Then there’s Company Y, a mid-sized business that switched to a high-deductible plan to reduce costs. While some employees were initially hesitant, the company offered education sessions to explain the benefits of the new plan. The result? Lower premiums and increased financial stability for the company.

What Can We Learn?

These success stories show that offering business health insurance is possible for companies of all sizes. It just takes a bit of creativity and planning. And the benefits—both for employees and employers—are well worth the effort.

Conclusion: Is Business Health Insurance Mandatory or Not?

So, there you have it, folks. Is business health insurance mandatory or not? The answer is: it depends. If you’re a large company with 50 or more employees, chances are you’re required to offer coverage. But even if you’re not legally obligated, there are plenty of reasons to consider it. From attracting top talent to boosting employee morale, the benefits are undeniable.

Now, here’s the call to action: if you’re still unsure about whether business health insurance is right for your company, do your research. Talk to experts, consult with brokers, and explore your options. And don’t forget to check out our other articles for more insights on managing your business. Remember, taking care of your employees is good for business—and good for everyone involved.

Table of Contents

- Understanding the Basics of Business Health Insurance

- Is Business Health Insurance Mandatory?

- Legal Requirements for Business Health Insurance

- Benefits of Offering Business Health Insurance

- Costs and Considerations

- Common Misconceptions About Business Health Insurance

- Real-Life Examples and Success Stories

- Conclusion: Is Business Health Insurance Mandatory or Not?

Mutuelle entreprise obligatoire ou pas ? Libre Assurances

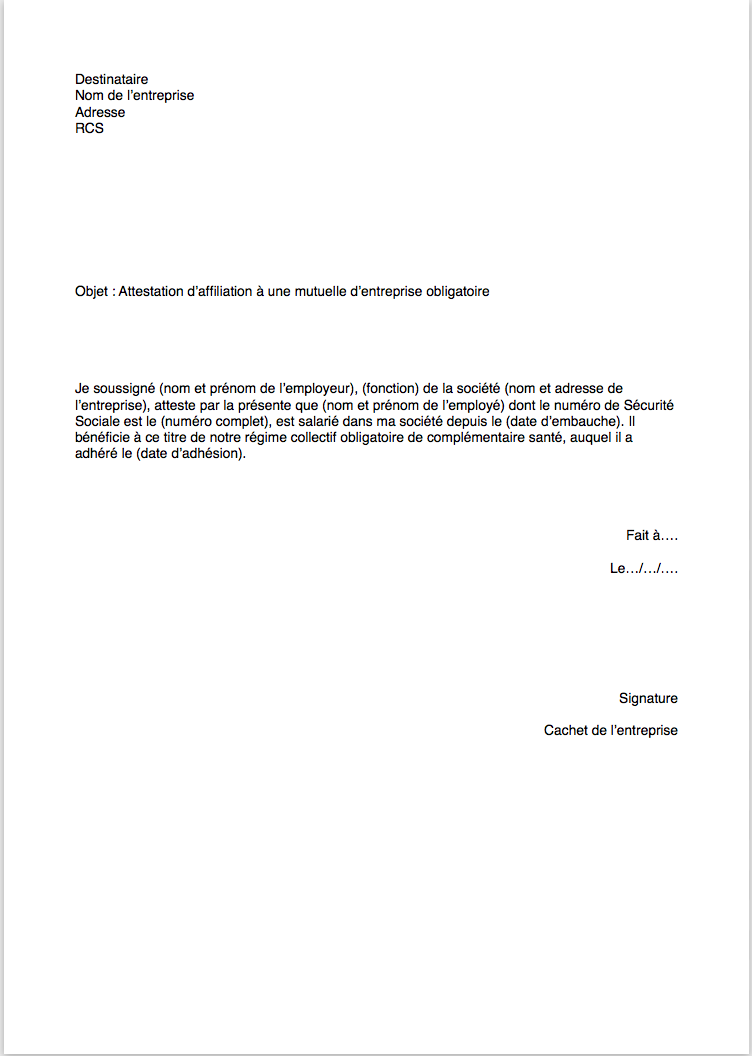

Modèle attestation mutuelle obligatoire

La mutuelle entreprise est elle obligatoire