State Farm & Quicken Issues? What To Know In 2024!

Are you finding yourself locked in a frustrating loop, endlessly re-entering your State Farm credentials into Quicken? You're not alone, and the reason might be more complex than a simple password mishap; the seamless integration you once relied upon may be a thing of the past.

For many Quicken users, the convenience of automatically linking their State Farm accounts for bill payment and financial tracking has become essential. However, recent reports indicate a growing disruption in this connection. Users are encountering persistent prompts to update their State Farm biller information within Quicken, only to be met with repeated requests for login credentials that, while valid on the State Farm website, fail to establish a link through Quicken. This issue, plaguing users since at least December 2023, has sparked widespread frustration and questions about the future of State Farm's compatibility with third-party financial management tools.

| Category | Information |

|---|---|

| Company Name | State Farm |

| Industry | Insurance, Financial Services |

| Headquarters | Bloomington, Illinois, USA |

| Founded | 1922 |

| Key Services | Auto insurance, Home insurance, Life insurance, Renters insurance, Banking, Investment products |

| Website | State Farm Official Website |

| Recent Developments | Reported issues with third-party financial tool integration (e.g., Quicken), potential changes in data sharing policies. |

The heart of the problem appears to stem from a potential shift in State Farm's data security policies. Approximately six years ago, State Farm implemented a system allowing authorized third-party Personal Financial Management (PFM) vendors to access customer financial and account data from its websites. This enabled these vendors to consolidate banking, investment, and insurance information for State Farm customers, streamlining their financial overview. However, whispers within the Quicken user community suggest that State Farm may be retracting this support for third-party services, citing security concerns as the primary driver. While unconfirmed by State Farm directly, anecdotal evidence, including claims of letters received by some users announcing the termination of third-party support, lends credence to this theory.

The timing of this potential policy change coincides with a growing emphasis on data privacy and security across the financial industry. Consumers are increasingly aware of the risks associated with sharing their financial information, and companies are under greater pressure to safeguard customer data. State Farm, as the largest insurance company in the United States, handles a vast amount of sensitive information, making it a prime target for cyber threats. Consequently, a decision to limit third-party access, even at the cost of convenience for some users, could be seen as a proactive measure to mitigate potential security breaches.

For Quicken users, the implications of this disruption are significant. The inability to automatically link their State Farm accounts necessitates manual tracking of bills and payments, adding time and complexity to their financial management routines. Furthermore, the intermittent nature of the connection, with repeated login requests and error messages, creates uncertainty and undermines the reliability of Quicken as a comprehensive financial tool. This has led some users to question whether Quicken will ever successfully resolve the integration issue with State Farm.

Adding to the frustration, users report encountering various error messages and technical glitches during the attempted relinking process. These include generic "broken link" messages, indications of no internet connectivity despite a stable connection, and even instances of Quicken crashing when attempting to delete problematic online billers, such as Teco Peoples Gas. These technical issues further compound the difficulties in managing State Farm bills through Quicken, exacerbating user dissatisfaction.

One user recounted their State Farm agent contacting State Farm's technical support, only to receive confirmation that State Farm is no longer supporting third-party links to billing information. Despite this apparent policy change, State Farm continues to appear in Quicken's list of bill vendors, creating further confusion and false hope for users seeking to re-establish the connection. This discrepancy between State Farm's official stance and Quicken's continued listing of the company as a biller underscores the lack of clear communication and coordination between the two entities.

While the automated link may be faltering, State Farm offers a multitude of alternative methods for managing and paying insurance bills. Customers can create an online account to view and pay bills, set payment reminders, and update payment information. State Farm also provides options for paying by phone, mail, or in person. For those seeking a streamlined online experience, State Farm offers the ability to pay bills without logging in, using a phone number, policy number, SFPP account number, or a key code found on the bill statement.

Moreover, State Farm has embraced modern security measures to enhance the online experience. Customers can now utilize passkeys, eliminating the need to remember passwords. With a passkey, users can log in using their device's fingerprint, facial recognition, or PIN, providing a secure and convenient alternative to traditional password-based authentication.

Despite the challenges with Quicken integration, State Farm remains committed to providing its customers with a seamless and secure billing experience. The company continuously updates its online platform and payment options to meet the evolving needs of its policyholders. Whether through online accounts, passkey authentication, or traditional payment methods, State Farm offers a comprehensive suite of tools for managing insurance bills with ease and confidence.

As the situation evolves, Quicken users are encouraged to stay informed about any potential updates or resolutions regarding State Farm integration. In the meantime, utilizing State Farm's direct payment options provides a reliable alternative for managing and paying insurance bills, ensuring uninterrupted coverage and peace of mind.

The disruption in Quicken's connectivity with State Farm serves as a reminder of the dynamic nature of technology and the importance of adapting to changing circumstances. While the convenience of automated integration is undeniable, alternative solutions and direct engagement with service providers remain essential for effective financial management.

Beyond the immediate inconvenience, this situation also raises broader questions about the future of data sharing and third-party integrations in the financial industry. As security concerns continue to escalate, companies may increasingly prioritize data protection over seamless connectivity, potentially leading to a more fragmented landscape of financial management tools.

Ultimately, the resolution of the Quicken-State Farm integration issue will depend on a collaborative effort between the two companies. Clear communication, transparent policies, and a commitment to both security and user convenience will be essential for restoring trust and ensuring a positive experience for customers seeking to manage their finances effectively.

In the interim, Quicken users are advised to explore State Farm's direct payment options and stay informed about any potential updates from both companies. By embracing alternative solutions and proactively managing their accounts, users can navigate this disruption and maintain control over their financial well-being.

The situation also underscores the importance of diversifying payment methods and not relying solely on a single integration or platform. Having multiple options for managing bills and payments provides a safety net in case of technical issues or policy changes, ensuring that financial obligations are met on time and without unnecessary stress.

As the digital landscape continues to evolve, adaptability and resourcefulness will be key for consumers navigating the complexities of online financial management. By staying informed, exploring alternative solutions, and proactively managing their accounts, individuals can maintain control over their financial lives and mitigate the impact of unexpected disruptions.

Moreover, this situation highlights the need for consumers to actively engage with their financial institutions and service providers, seeking clarification on data sharing policies and security practices. By asking questions and demanding transparency, individuals can make informed decisions about how their data is used and protected, safeguarding their financial well-being in an increasingly interconnected world.

In conclusion, while the disruption in Quicken's connectivity with State Farm presents a temporary inconvenience for some users, it also serves as a valuable reminder of the importance of adaptability, resourcefulness, and proactive engagement in managing one's financial affairs. By embracing alternative solutions, staying informed, and demanding transparency, consumers can navigate the complexities of the digital landscape and maintain control over their financial well-being.

The long-term implications of this situation remain to be seen. Will State Farm permanently restrict third-party access to its data? Will Quicken find a workaround to restore seamless integration? Only time will tell. In the meantime, users are encouraged to stay vigilant, explore alternative solutions, and advocate for policies that prioritize both security and user convenience.

As the financial industry continues to evolve, consumers must remain informed, adaptable, and proactive in managing their financial lives. By embracing new technologies, exploring alternative solutions, and demanding transparency from their service providers, individuals can navigate the complexities of the digital landscape and maintain control over their financial well-being.

The challenges faced by Quicken users in linking their State Farm accounts underscore the importance of robust customer support and clear communication from both companies. When technical issues arise, users need access to timely and accurate information to resolve their problems effectively. A lack of transparency or responsiveness can exacerbate frustration and erode trust.

Furthermore, this situation highlights the need for ongoing collaboration between financial institutions and technology providers to ensure seamless and secure integration of their services. By working together to address technical challenges and align their policies, these companies can create a more user-friendly and reliable experience for their customers.

In the meantime, Quicken users are encouraged to explore alternative financial management tools and strategies. There are many other software programs and apps available that offer similar features and functionality, and some may provide better integration with State Farm or other financial institutions. By diversifying their financial management toolkit, users can reduce their reliance on a single platform and mitigate the impact of technical issues or policy changes.

Ultimately, the resolution of the Quicken-State Farm integration issue will require a commitment from both companies to prioritize the needs of their customers. By working together to address technical challenges, improve communication, and ensure seamless and secure integration, they can restore trust and provide a positive experience for users seeking to manage their finances effectively.

The situation also serves as a reminder of the importance of backing up financial data regularly. In case of technical issues or data loss, having a recent backup can help users recover their information and avoid significant disruptions to their financial management routines. Many financial software programs and apps offer automatic backup features, which can provide an extra layer of security and peace of mind.

As the digital landscape continues to evolve, consumers must remain vigilant in protecting their financial information. By using strong passwords, enabling two-factor authentication, and regularly monitoring their accounts for suspicious activity, individuals can reduce their risk of fraud and identity theft. It is also important to be cautious when sharing financial information online and to only use reputable websites and apps.

The challenges faced by Quicken users in linking their State Farm accounts highlight the need for greater transparency and accountability in the financial industry. Consumers have a right to know how their data is being used and protected, and they should be able to easily access and control their financial information. By advocating for stronger consumer protections and demanding greater transparency from financial institutions and technology providers, individuals can help create a more fair and equitable financial system.

In the end, the resolution of the Quicken-State Farm integration issue will depend on a collective effort from consumers, financial institutions, and technology providers. By working together to address technical challenges, improve communication, and promote transparency and accountability, we can create a more seamless, secure, and user-friendly financial experience for all.

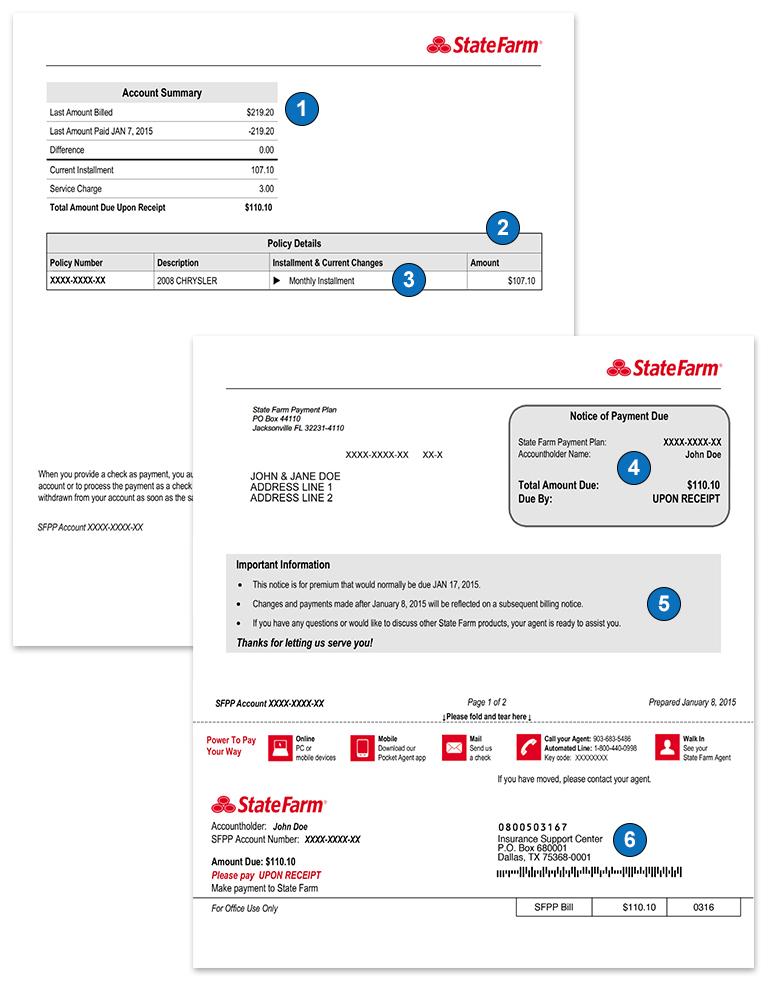

Understanding your Insurance Bill State Farm®

State Farm Bill Pay Easy And Secure Online Payments

"Don't Fall for This Scam!" CA Democrats' Cost of Living Failures CA